Medical Claims: What They Are & Why They Matter for Reimbursement

Medical claims are one of the most essential parts of the revenue cycle management process, because without them, doctors wouldn’t be able to receive payments for rendered services.

And that’s why healthcare providers, facilities, and organizations should know how to manage medical claims, what they actually are, and how they directly impact the practice’s growth.

Do you want to know how medical claim processing works? How to make a claim for faster and smoother reimbursements? If so, read this guide to the end to learn everything about health insurance claims.

What is an Insurance Medical Claim?

Don’t get confused by the terms; whether we say “medical claims” or “insurance medical claims,” both are used interchangeably.

Let’s come to the point: what is a claim or medical claim? Basically, a claim is a bill or invoice issued by doctors, physicians, and healthcare providers to health insurance companies for reimbursement of the payments for services or treatments rendered to the patient.

Why Do Medical Claims Matter?

Medical claims function as a bridge between the patient care and the provider’s financial reimbursement — and that’s the reason why it matters. Here are some of the reasons listed down based on three aspects: for medical providers, the healthcare system, and patients – the benefits medical claim offers to them.

| For Solo Practitioners / Facility Providers | For Patients | For Healthcare Network / System |

|---|---|---|

| It ensures financial stability by enabling providers to receive accurate payments through coded diagnoses and treatments. | Claims support patients by reducing out-of-pocket costs, ensuring they don’t need to pay the full amount for treatment/services. | Medical claims serve as proof that payers use to ensure treatments are necessary and to prevent fraud. |

| Claims help in improving revenue cycle management. | Medical claims support clinical continuity by serving as documented records that help providers and insurers plan better patient care. | It ensures compliance within the healthcare system. |

| Accurate and timely claim submissions help providers/practices reduce denials and boost cash flow. |

What are the Types of Medical Claims?

Let’s know about the various types of medical claims, who uses them, and when.

Institutional Claims

Institutional claims fall into two categories: softcopy (UB-04 or CMS-1450) or electronic record use 837I (I stands for Institutional).

Institutional forms are used by healthcare facilities, clinics, and organizations to document services rendered, such as medical equipment, diagnoses, and treatments/services delivered through medical coding, which helps insurers know why and what care is offered to the patient.

Professional Claims

Professional claims also have two categories: the CMS-1500 form sent to payers by mail and 837P (P-Professional), an electronic version of a claim – used more for fast, efficient submissions.

Further, professional claims are often submitted by solo providers, such as mental health therapists, psychologists, physicians, or other licensed healthcare providers who are directly connected to patients. The purpose of these claims is the same: help providers receive their payments for services on time.

Dental Claims

Dental claims are another type of claim which used by dentists, oral surgeons, and orthodontists. The forms are of two types: the ADA Dental Claim Form J430, a paper form submitted by mail, and the 837D, an electronic version.

Through these forms, dentists documented treatments by using accurate dental codes, mentioning tooth numbers and surface areas (if applicable). By doing this, dentists would be able to earn their payments accurately.

How Does Medical Claim Processing Work?

In the U.S. healthcare industry, submitting insurance claims to the payers isn’t as easy as writing about it. It’s the whole process that either leads to earning money or to losing it. That’s why understanding how to submit medical claims is mandatory for providers, and especially billers, to achieve first-pass claim submission and improve the clean claim rate.

Want to know about the clean claim rate? Read our full guide, which might help you boost your clean claim ratio and enhance your practice’s cash flow!

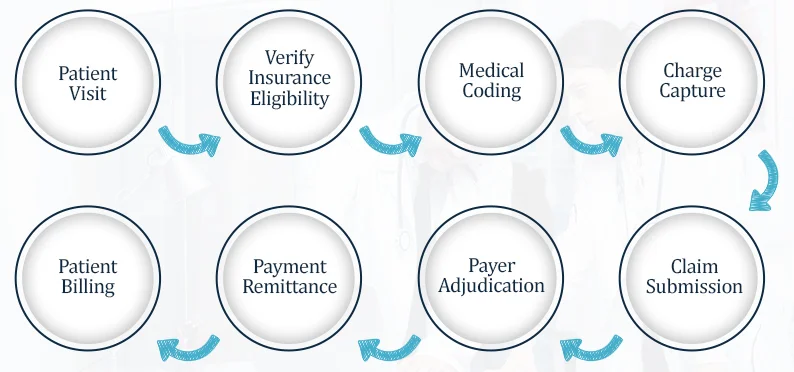

Let’s know how medical claim processing works, step by step.

Patient Visit

The process begins when the patient schedules an appointment via call or visits the doctor. During the visit, the front-end medical billing staff at the clinic or hospital ask patient about their personal information. It includes their name, date of birth, address, insurance ID number, and phone number.

Verify Insurance Eligibility

Once the staff has the patient’s demographics and insurance information, they begin the eligibility verification process. The step is crucial, as it ensures insurance coverage plan, copays, deductibles, and validity. It helps ensure the patient is eligible for those services/treatments while streamlining the billing process.

Medical Coding

During the patient visit, the provider maintains notes (medical notes), which are necessary for the claim submission. By using these physicians’ clinical notes, medical coders translate diagnoses and treatments/services into standardized medical codes: CPT, ICD-10, and HCPCS.

Medical coding is one of the complex processes during the claim submission, because a minor error or mismatched codes can lead to rejections or even denials, which can badly hurt the practice’s revenue. Often, providers and practices outsource medical coding services to ensure accurate, fast reimbursement.

Charge Capture

After medical coding, the billing team assigns medical charges/amount for rendered services or treatments, ensuring they align with payer-specific plans to reduce the risk of denials.

Claim Submission

Claim submission is the final step that the provider or biller takes. However, confirm that the claim is submitted within the specified timeframe to ensure a smooth billing process.

Payer Adjudication

Payer adjudication is the process by which a payer receives medical claims and verifies all information related to the rendered service. During this step, payers either accept, reject, or deny the claim. If the claims are denied, use standardized denial codes to help billers understand why the denials occurred and how to re-appeal to recover lost revenue.

Payment Remittance

Once the payer decides whether to pay, reject, or deny the medical claim, the payment remittance method begins. Payment remittances are communicated through an Explanation of Benefits (EOB) or an Electronic Remittance Advice (ERA), which detail approved amounts, denied charges, adjustments, and patient responsibility. If the payer denies the claim, use CARC/RARCs on the document to help understand the reasons for those denials.

Patient Billing

If the insurance company sends the payment, the final step is to process it in the patient portal, under patient billing. This payment is sent using medical billing software or by mail. The invoice includes the service charge and any amounts not covered by the insurance plan.

What Makes Medical Claims Submission Difficult?

U.S. healthcare billing is complicated by payer-specific policies and regulatory changes, making medical claim submission difficult.

Inaccurate Medical Codes

Accuracy matters the most when it comes to translating clinical notes into the medical codes! A minor mistake in using CPT, ICD-10 codes, an outdated one, or a wrong one can trigger an audit, which leads to rejection or even denials.

Constant Healthcare Rules Changes

Every year, payers change codes, rules, and even policies related to the billing process, making claim submission difficult. To stay compliant, avoid denials and penalties, it’s mandatory to keep your billing staff up to date on healthcare regulatory changes.

Late Claim Submission

Timely claim submission is essential for faster, more accurate payments. The time limit for submitting claims is approximately 60 to 180 days, depending on payer requirements. If it is delayed, the provider loses revenue and can’t recover it.

Missing Prior Authorization

For some treatments and services, the payer requires prior-authorization number. If it’s missing or not approved by the payer before the service is delivered, denials occur.

Let’s Wrap Up

In short, claims are the forms that help solo practitioners, hospitals, and large healthcare organizations receive payment for the services they render. Without promptly submitting medical claims, the provider loses money, which directly harms the revenue cycle.

Challenges like frequent changes in payer coding and rules, inaccurate medical codes, and prior authorization issues can slow down the billing process or even result in denials. To overcome these challenges, many practices are now partnering with top medical billing companies such as eClaim Solution, which have the expertise to handle them efficiently and effectively — helping practices grow, boost cash flow, and ensuring providers can focus more on what matters most: patients.

Frequently Asked Questions

Medical claim insurance is a form submitted by providers, billing teams, or RCM managers to payers to obtain quick, accurate reimbursement for rendered services.

It typically takes 15 to 30 days if the insurers/payer find everything accurate and fully compliant with the policies. Further, complex medical billing processes can take longer, especially when requirements are missing or found incorrect.

Professional, institutional, and dental claims are major types of medical claims. Solo providers use professional claims, healthcare organizations use institutional claims, and dental claims are only used by dentists or oral surgeons. All claims serve the same purpose: helping providers get paid on time.

Some of the rules that you should follow during claim submission for the smooth medical billing process are;

- Make sure patient demographics are entered accurately.

- Ensure that every field on the form is filled in.

- Verify that the prior authorization number is approved and documented.

- Use of updated and valid modifiers, CPT, and ICD-10 codes.

- Avoid submitting duplicate claims.

- Ensure to follow updated payer-specific policies.

Book a Consultation

Categories

- ╰┈➤ Medical Billing

- ╰┈➤ Specialty Billing

- ╰┈➤ Credentialing

- ╰┈➤ Medical Coding

Table of Content

- What is an Insurance Medical Claim?

- What are the Types of Medical Claims?

- How Does Medical Claim Processing Work?

- What Makes Medical Claims Submission Difficult?

- Let’s Wrap Up

- FAQs

Comprehensive Healthcare Management Services